On this page:

13.1 - What is a Work Experience in Industry unit?

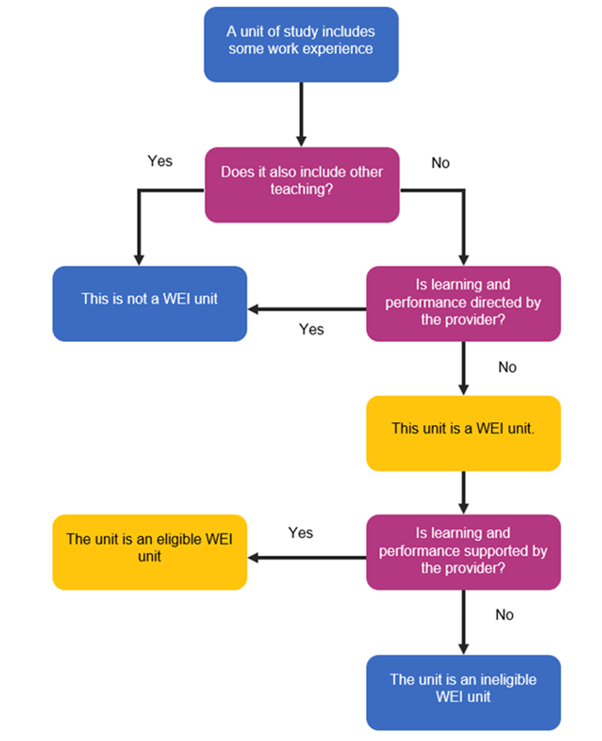

HESA requires that Work Experience in Industry (WEI) units be treated differently to other units of study [see HESA Schedule 1 for the definition of ‘work experience in industry’]. Figure 1 below provides a summary of this part.

WEI units are those which comprise totally of work:

- that is done as a part of, or in connection with, a course of study undertaken with a provider; and

- the purpose of which is to obtain work experience relevant to the course of study

A unit is not a WEI unit if all of the following are performed by the staff of the provider or by persons engaged by the provider:

- ongoing and regular input and contact with students;

- oversight and direction of work occurring during its performance, not just the progress of a student’s work;

- definition and management of the implementation of educational content and objectives of the unit;

- definition and management of assessment of student learning and performance during the placement; and

- definition and management of the standard of learning and performance to be achieved by the student during the placement [Administration Guidelines section 19]

WEI units are reported on element 337 of the TCSI system.

13.2 - Do WEI units attract CGS funding?

Eligible WEI units attract CGS funding. Ineligible WEI units are not counted as student load for funding under the CGS [HESA subsections 33-30(1) and 33-30(1A)].

13.3 - Can a provider charge a student contribution or tuition fee for WEI?

Whether a student can be charged for a WEI unit depends on the level of support provided to the student enrolled in the unit and corresponds to eligibility for CGS funding.

Eligible WEI units

A provider may charge a student contribution amount or tuition fee for WEI units, and the unit will attract CGS funding (where relevant), if the student is not exempt from paying a student contribution in relation to the unit, and receives support for learning and performance from the provider or persons engaged by the provider.

A student is receiving support for learning and performance if all of the following are performed by staff of the provider or persons engaged by the provider:

- interaction between the supervisor and the student, which may include site visits

- organisation of student placements

- ongoing monitoring of student work and progress; and

- assessment of student learning and performance during the placement [Administration Guidelines section 20]

In this case, the WEI unit is coded as ‘1’ on element 337 of the TCSI system.

WEI units where no support is provided

If the provider, or someone engaged by the provider, is not providing support to a student’s learning and performance for a WEI unit, the unit is wholly WEI and the provider cannot charge the student a student contribution amount or tuition fee, and the unit is an ineligible WEI unit that will not attract CGS funding. The student is an exempt student [HESA subsection 169‑20(2); Administration Guidelines section 20].

In this case, the WEI unit is coded as ‘2’ on element 337 of the TCSI and as an exempt student on element 490.

13.4 - When is a student enrolled in a WEI unit a Commonwealth supported student?

A student is to be enrolled and reported to the department as a Commonwealth supported student in relation to a WEI unit if they are, or have been, Commonwealth supported for another, non-WEI, unit of study in that course [HESA subsection 36-10(6)].

Figure 1: WEI arrangements