Higher educational attainment is associated with lower financial stress.

On this page:

Introduction

Financial stress can be defined as difficulty meeting basic financial commitments due to a shortage of money. Financial stress increases the risk of homelessness and can negatively impact an individual’s health and psychological well-being.[1] Not surprisingly, low income is a significant cause of financial stress.[2] However, previous research has also linked higher financial literacy with lower financial stress.[1] Using data from the 2014 ABS General Social Survey, we show that the likelihood of reporting financial stress decreases with increasing educational attainment.

Cash flow problems

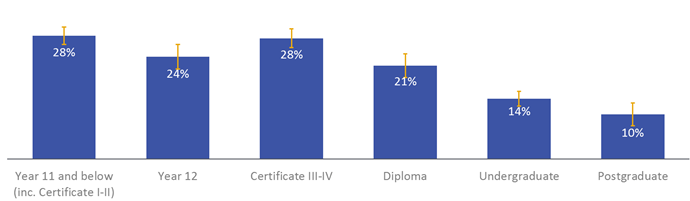

One indicator of financial stress used in the ABS General Social Survey[3] is the number of cash flow problems experienced over a year. These problems can include an inability to afford bills and other household expenses. Cash flow problems can decrease living standards and deprive households of basic living needs[1]. Our results show that the likelihood of having cash flow problems generally decreases with higher educational attainment (Figure 1). The effect of education does not hold entirely after controlling for confounding variables such as income. Noticeable differences were only observed between the extreme groups such as Postgraduates and Year 11 and below. Regardless of an individual’s income, their spending habits will also determine whether they experience cash flow problems.

Ability to raise emergency funds

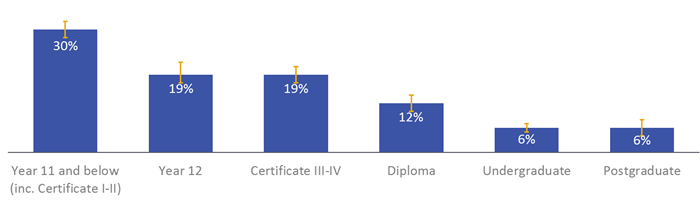

The ability to raise emergency funds of $2,000 within a week is another indicator of financial stress used in the ABS General Social Survey. The proportion of people being unable to raise this amount of money falls as educational attainment increases (Figure 2). This relationship holds after controlling for a range of confounding variables such as income and occupation. Large differences were found between Year 11 and Below and higher levels of educational attainment. There were also differences between Undergraduates and Year 12, Certificates and Diplomas.

Figure 1. Proportion of 30-64 year olds that have experienced one or more cash flow problems, by highest level of educational attainment, 2014.

Source: General Social Survey, 2014.

Notes: Data filtered by age (30-64), not currently studying. Survey weights applied. Post-matching logit results show education is associated with cash flow problems (χ2 = 23, p<0.001, N = 848). Significant pairwise comparisons were found for; postgraduate versus year 11 and below (p=0.015), postgraduate versus year 12 (p=0.043), and postgraduate versus diplomas (p=0.030).

Figure 2. Proportion of 30-64 year unable to access emergency funds, by highest level of educational attainment, 2014.

Source: General Social Survey, 2014.

Notes: Data filtered by age (30-64), not currently studying. Survey weights applied. Post-matching logit results show education is associated with an individual’s ability to produce emergency money (χ2 = 24.6, p<0.001, N = 848). Significant pairwise comparisons were found for; postgraduate versus year 11 and below (p = 0.026), postgraduate versus year 12 (p<0.001), and bachelors versus certificates (p = 0.028).

Data and methodology

The analysis in this paper used 10,200 person-level records from the ABS General Social Survey, 2014 (Cat. No. 4159.0). Propensity score matching (PSM) using age, gender, labour force status, family type, occupation, income, and country of birth, was used to simulate a randomised control trial in the sample. Significance of financial stress and highest education was assessed with logit generalised linear models performed on the propensity-score-matched (PSM) sub-populations. This provides the strongest possible evidence of cause and effect in cross-sectional data.

[1] Steen A & MacKenzie D (2013) Financial stress, financial literacy, counselling and the risk of homelessness, Australasian Accounting, Business and Finance Journal 7: 31-48; Australian Department of Health (2017). Retrieved from URL https://headtohealth.gov.au/meaningful-life/feeling-safe-stable-and-secure/finances, Accessed 25/04/19.

[2] KPMG (2017) Financial Stress in Australian Households: The haves, the have-nots, the taxed-nots and the have-nothing, Sydney Australia

[3] Australian Bureau of Statistics (2014) 4159.0 – General Social Survey: Summary Results, Australia, 2014 URL https://www.abs.gov.au/ausstats/abs@.nsf/mf/4159.0